Modular construction is having a moment – and for good reason.

his innovative prefabricated building approach is often faster, cheaper, and greener than traditional on-site construction. As a result, the modular construction market is booming, especially in North America (with the United States leading the charge) and gaining momentum worldwide. In this post, we’ll explore why modular building is taking off, look at market size stats and trends globally, highlight key growth drivers (like housing demand, speed, sustainability, and tech), and discuss the outlook for this construction trend in 2025 and beyond.

Modular Construction Boom in North America

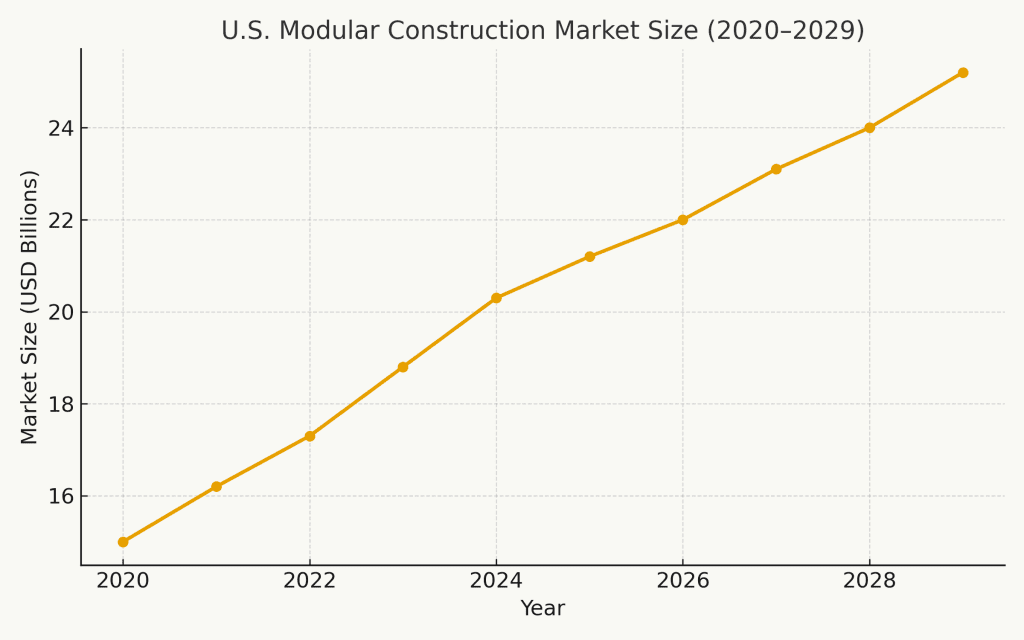

In the United States, modular construction has quickly moved from niche to mainstream. In 2024, the U.S. modular construction market reached about $20.3 billion, accounting for roughly 5% of total new construction – a notable jump in adoption. Forecasts show it could grow to $25+ billion by 2029, with a healthy ~4.5% annual growth rate, outpacing the broader construction industry’s growth. To put it simply, modular building is expanding faster than traditional building methods in the U.S.

North America overall is seeing robust growth. The North American modular market (including the U.S. and Canada) was valued around $28.6 billion in 2024 and is projected to reach $43+ billion by 2033. Key sectors driving this boom include multifamily housing, where factory-built apartments and condos help address housing shortages, as well as commercial projects like offices, data centers, and hotels adopting modular techniques. Geographically, demand is strong across the continent – for example, the U.S. West Coast (notably California) leads with high modular uptake, thanks to a pressing need for housing and significant tech industry investment in construction innovation. Dense urban areas in the Northeast (New York, Boston, etc.) and rapidly growing Southern states are also turning to modular solutions despite some regulatory hurdles.

Why are American builders so keen on modular? Much comes down to efficiency and economics. Surveys show that speed to market (cited by ~81% of firms) and cost efficiency (~68%) are top reasons developers choose modular construction. Building modules in a factory while site work happens in parallel drastically cuts project timelines. Likewise, controlled factory conditions reduce material waste and labor costs, improving the bottom line. Another practical factor is the ongoing skilled labor shortage in construction – over 80% of U.S. contractors struggle to find qualified workers, and off-site modular methods help fill this gap by requiring fewer on-site laborers. In short, modular building addresses many challenges facing the construction industry in North America, fueling its rapid growth.

Figure: Modular construction market size in the United States from 2020 to 2029 (in USD billions). The U.S. modular market has grown from around $15 billion in 2020 to over $20 billion in 2024 and is forecasted to reach roughly $25 billion by 2029. This growth rate exceeds that of the overall construction sector, indicating robust interest in off-site building methods.

Global Market Growth and Trends

The modular construction boom isn’t confined to North America – it’s a global phenomenon. The global modular construction market was valued at $87.6 billion in 2022 and is expected to grow around 7% annually through 2030. In fact, recent estimates put the global market at over $100 billion in 2024, on track to exceed $160 billion by the end of the decade. This impressive growth trajectory underscores that prefab and modular building methods are gaining worldwide acceptance as a construction trend in 2025 and beyond.

Regional outlook: North America and Europe currently dominate the modular construction market in terms of adoption and market share. The U.S. and Canada are investing heavily in modular solutions, and many European countries also use modular building for everything from housing to schools. Meanwhile, the Asia-Pacific region is the fastest-growing market for modular construction. Rapid urbanization and infrastructure needs in countries like China, India, and Japan are driving huge demand for faster building methods. Governments and developers in these countries are embracing modular techniques to quickly add housing and commercial space in booming cities. For example, Asia has produced some headline-grabbing modular projects (like a 55-story prefabricated high-rise in Singapore), showcasing that modular can scale up to very large structures.

Several global trends are fueling this uptake. One is the universal need for speed and cost control in construction – time is money everywhere. Modular construction can cut building times by an estimated 30–50% compared to conventional methods. Factory fabrication means site work and module production happen simultaneously, significantly compressing schedules. This speed advantage is appealing from New York to New Delhi. Similarly, cost savings of around 20% are being achieved thanks to economies of scale, reduced on-site labor, and less material waste. And speaking of waste: modular building is far more sustainable, generating roughly 50% less waste on site than traditional construction projects. These efficiency gains and green benefits align well with global priorities for sustainable development.

Another notable trend is that modular construction is expanding into diverse sectors. It’s no longer just for single-family homes or temporary structures. Around the world, modular techniques are being used for apartment complexes, hospitals, schools, hotels, data centers, and even large-scale infrastructure. This broadening of use cases globally reinforces that modular building isn’t a niche – it’s becoming a go-to solution for various construction needs.

Key Drivers of Modular Construction Growth

What’s driving the boom in modular construction and prefabricated building? Several converging factors are pushing this trend forward:

- Skyrocketing Housing Demand & Shortages: Many countries, especially the U.S., face a housing shortage and affordability crisis. Modular construction offers a way to quickly add housing units at lower cost. Cities like Los Angeles and New York have turned to modular homes as a rapid solution for building affordable housing and shelters. Governments are also backing modular builds to help close housing gaps – even the White House highlighted modular construction as a tool to boost affordable housing supply quickly. The growth of modular homes is directly tied to this urgent need for faster, cheaper housing.

- Speed and Efficiency: Faster construction is one of the biggest selling points of modular building. Because modules are built in a factory at the same time site prep is underway, projects can be completed in a fraction of the time – often 30-50% quicker than traditional construction. This speed to market can be critical for developers looking to capitalize on demand or for public projects needing quick delivery (like schools or disaster-relief housing). Faster build times also mean lower financing and labor costs. It’s no surprise that speed is cited as the number one driver for adopting modular techniques.

- Sustainability and Waste Reduction: Green construction is another major driver of modular’s popularity. Building in controlled environments allows for precise use of materials and easier recycling of scraps, resulting in far less waste – studies show modular projects produce up to 50% less waste compared to on-site builds. Additionally, factories can optimize energy use and often utilize sustainable or recycled materials. The finished buildings themselves tend to be very energy-efficient. All of this helps reduce the carbon footprint of construction. In an era when construction waste and emissions are big concerns, modular building is seen as an eco-friendly alternative that supports global sustainability goals.

- Technological Advancements: Modern tech is making modular construction more feasible and attractive than ever. Building information modeling (BIM) software allows detailed 3D digital designs and pinpoint-accurate module fabrication, eliminating errors. Automation and robotics in factories help assemble modules with speed and precision. Some factories even use AI and data analytics to streamline production schedules and supply chains. Moreover, new materials and methods – from 3D-printed building components to advanced wood composites – are expanding what’s possible with prefab construction. These innovations mean today’s modular buildings are high-quality and customizable, shedding the old image of “cookie-cutter” prefabs.

Future Outlook: From Trend to Mainstream

All signs point to modular construction continuing its upward trajectory in the coming years. Industry forecasts unanimously project steady growth. Analysts predict the global modular construction market could top $160 billion by 2030 if current trends hold. In North America, the sector’s value is expected to keep climbing with mid-single-digit growth rates through the next decade. What was once a fringe approach is fast becoming a core part of the construction industry. In fact, experts call modular building a key construction trend of 2025 and beyond – and not just a trend, but a fundamental shift in how we build.

We can also expect more institutional support and investment. Government incentives and policies are increasingly favorable toward modular and off-site construction, particularly when it comes to affordable housing and sustainable development. Large developers and construction firms are forging partnerships with modular manufacturers, and new startups are entering the space with innovative factory models. As more success stories roll out (from high-profile modular hotels to entire modular apartment blocks), the confidence in this approach grows.

Of course, there are challenges ahead. Building codes and zoning laws need to keep pace with off-site construction techniques, and the traditional construction workforce will need retraining to adapt to factory-based processes. However, these hurdles are gradually being overcome as the benefits of modular become undeniable. The desire for faster project delivery, cost savings, and sustainable practices is not going away. Modular methods directly address these demands, which is why they’re here to stay.

In summary, the modular construction market boom is more than just hype – it reflects real efficiencies and solutions that the construction world needs. From the U.S. to Europe to Asia, prefab and modular building are revolutionizing how we create the spaces where we live and work. And with strong momentum, ongoing technological innovation, and growing acceptance, modular construction is poised to evolve from a rising trend into a mainstream construction practice in the years ahead. For anyone interested in construction trends 2025, one thing is clear: modular is a big part of the future of building.

Sources

- Mordor Intelligence – United States Modular Construction Market Size & Growth (2020–2029)

- Grand View Research – Modular Construction Market Size, Share & Trends Report

- Fortune Business Insights – Modular Construction Market Size, Growth & Forecast

- Precedence Research – North America Modular Construction Market Outlook

- Dodge Construction Network – Prefabrication and Modular Construction Survey

- U.S. Chamber of Commerce – Construction Workforce Shortages Report

- National Institute of Building Sciences – Waste Reduction in Modular Construction

- McKinsey & Company – Modular Construction: From Projects to Products

- White House – Housing Supply Action Plan

Wondering how storytelling and smart marketing can advance offsite construction, mass timber, and sustainability in North America?

Whether you’re in AEC, sustainability, or shaping the built environment, we’d love to connect. Let’s talk – or explore BuildBetter.Marketing.

Structure needs story. Jib delivers.